-

View all news of TheECheck.com

Posted on June 5, 2020The Direct Payment Services That Are Changing The Future Of Payments

Nowadays, every customer prefers the comfort and ease of access services in every industry. This also includes payment processing services. In respect of popular payment methods like a debit card and credit card processing, e-wallets, now most of the people prefer to pay using direct payment services at the comfort of their convenience. This includes services like ACH payments and e-wallets services. It helps them to set an auto-debit feature with the help of recurring billing facilities. TheEcheck is working with the team of industry experts to provide you with the best possible payment processing solution as per your business needs. Contact us today at +1-855-403-3855.

A History From Where All The Direct Payment Services Started

The direct payment services started from the roots in the era of the 1870s. At that time, EFT (Electronic Fund Transfer) was initiated. This service attracted a lot of business merchants and customers to take advantage of the benefits provided by direct payment services to send and receive funds without any physical need to interact. In the 1960s, the plastic cards came into the industry to transfer funds with the help of direct payment services. Later on meanwhile in 1972, Automated Clearing House that is now termed to be as ACH is introduced. This technology helped the customers and businesses to transfer a large number of funds in batches of transactions. Now thanks to the advanced internet services, a customer can purchase any desired products or services at a click of a button. All the payments can be settled with the help of direct payment services like ACH, echecks ,e-wallets to settle the funds directly straight to the acquiring bank account.

How To Choose The Best Processor To Accept Direct Payment Services For Your Business?

There can be a lot of hassle when you are searching for an adequate digital payment processor who can support you with direct payment services. There are a lot of different payment processors available in the market. But you are the one who knows your needs, and you should opt for a processor that understands and provides you with the solution you need. By offering direct payment services to your customers, you can attract a lot of customers, and this may help you to achieve high business revenue.

If you are a small business merchant who wants a diversified payment processing solution to have a profitable deal. Then you should contact TheEcheck. We understand what a business requires as per their type of trade in the industry. That’s why we offer you with the best possible payment processing solution. Especially for e-commerce and small business merchants. We offer an easy merchant account application procedure. A merchant needs to fill the application form with all the required information completely. After that, you need to submit the request form along with all the required documents to complete account verification procedures.

Some of the features we provide with our merchant accounts services are:

- Payment gateway solution under the regulations of PCI Compliance.

- Low processing charges for the payments.

- Faster settlement of funds within 2-3 business days.

- 24*7 Customer tech support service so that you can always have a hassle-free payment processing experience.

If you are still stuck in something or need further assistance, You can reach us at info@theecheck.com.

The post The Direct Payment Services That Are Changing The Future Of Payments appeared first on TheECheck.com.

-

View all news of Payoneer

Posted on October 22, 201911 Tips for Getting Your Online Store Holiday-Ready in 2019

Analysts are predicting as much as an 18% increase in sales for the 2019 holiday season – a staggering $144 to $149 billion worth of sales during this popular buying period. With Thanksgiving, Black Friday and Cyber Monday (not to mention Christmas, Hanukkah, Kwanzaa and Diwali) rapidly approaching, it’s time to ask yourself, “Is my online store ready for the holidays?”.

Don’t worry if the answer is a firm no. There are a handful of simple and effective steps you can take to prepare yourself for the expected sales surge. Here are 11 tips to help get your store holiday-ready in no time.

Holiday Season Prep #1: Know When to Sell

Last year there was a full month (or 31 shopping days) between Thanksgiving and Christmas. This year, there are only three weeks (or 25 shopping days). That makes a big difference in how you structure your sales channel, stock your products, and handle orders and shipping.

If you look at calendars from 2018’s online sales, you’ll see distinctive spikes on certain days when the most online shopping occurred. Make sure you have all your big products, shipping materials and customer service staff ready and waiting on these days. Plan your promotions for these times. In 2019, we’re talking about the three Mondays and Tuesdays in December, specifically.

Holiday Season Prep #2: Get Schooled

While it’s important to be proactive with your holiday prep, the first step is making sure you know what to do. Read up on tried and true practices that always help online sellers increase productivity, and brush up on some new sales tactics that are being adopted for the modern generation.

Holiday Season Prep #3: Have Plenty of Inventory on Hand

Once you’ve created a smart marketing calendar based on the projections we spoke about above, it’s time to get your stock room ready. Make sure you are sufficiently stocked during the entire holiday season to accommodate all your customers. Clothing took a whopping 57% of the online retail sales in 2018 with footwear and other apparel coming in behind them so, if you are in this industry, stock up!

Holiday Season Prep #4: Go Global

In the era of cross-border sales, your market is no longer limited to any specific country or territory. Remember, however, that different countries celebrate the holidays at different times. For example, Hanukkah is from December 22nd through December 30th, meaning Jewish customers in foreign markets might choose to do some shopping around Christmas time.

Holiday Season Prep #5: Be Mobile-Friendly

In 2018, 61% of online purchases were made on a smartphone, signaling that mobile is well on its way to dominating the online shopping sphere. Make sure your website, product pages, and checkout platform are mobile-friendly to give shoppers a fast, smooth, and easy process.

Holiday Season Prep #6: Become an Amazon Seller

Amazon makes up roughly 40% of all online sales. That’s tremendous! Get a piece of the pie by becoming an Amazon seller.

Holiday Season Prep #7: Invest in Some Extra Capital

Keeping products in stock, paying shipping charges, staying on top of extra staff hours, and other expenses can really start to add up around the holidays. To get through the season, some extra capital couldn’t hurt. With Payoneer’s Capital Advance program, businesses can get additional working capital to help ensure that this holiday season is a successful one.

Holiday Season Prep #8: Add a Personal Touch

The holiday season is hectic for everyone, making it difficult to stand out among your customers. By adding a personal touch to their shopping experience (e.g., a gift, personalized message or even a hand-written note wishing good tidings for the coming year), you’ll help ensure they remember you.

Holiday Season Prep #9: Utilize Click and Collect

Click and collect is one of the biggest shopping trends of 2019, as it gives customers the ability to buy online and collect their purchases at a nearby location. This helps them avoid fighting through the crowds at brick and mortar stores while providing a convenient way to quickly get their gifts.

Holiday Season Prep #10: Make Your Presence Known and Remarket

Marketing is essential at this stage in the game. Consumers are expecting an email from you to tell them about holiday sales, discount codes, or other promotions they can take advantage of. Whether it’s a fun and exciting sales email or an eye-catching banner ad on social media, shout out to your customers and make yourself known.

Already been seen? According to a recent Google report, online shoppers abandon their carts 77% of the time. A good way to bring these straying customers back to your store is to re-engage them on a different platform. Online ads, countdown timers, YouTube campaigns, Facebook ads, emails, whatever it is. Remarket your products to remind your customers why they wanted to shop with you in the first place.

Holiday Season Prep #11: Have Shipping Down Pat

Shipping is a significant deciding factor for online shoppers. Free shipping is enticing, making an online store more appealing. This year, Free Shipping Day is December 14, 2019, which is when more than 1,000 online stores waive shipping charges and even minimum order requirements – maybe it’s time for your store to join them.

The post 11 Tips for Getting Your Online Store Holiday-Ready in 2019 appeared first on The Payoneer Blog.

-

View all news of Payoneer

Posted on October 17, 2019Can Digital Banking Initiatives Deliver Better Banking for SMBs?

SMBs make up almost half of businesses across most industries and there are currently some 30 million small and medium-sized businesses just in the US alone. With such a large segment of businesses being represented, it’s understandable that services will look to cater their offerings to small and medium-sized companies.

Banking is one industry that is slowly coming around to this realization. However, SMBs have different banking needs than your typical enterprise and corporations.

Gupta said it eloquently when he mentioned that Citibank doesn’t look at small businesses as small customers. Instead, they are the local operations of the enterprises of tomorrow. With digital advancements, banks are hoping to deliver a better banking system for smaller businesses across the globe.

This was the topic of conversation at the latest Payoneer Forum held in India. Check out some valuable insights. Click below to see the full presentation.

Digital Banking is the Wave of the Future

No matter who you ask, the answer is the same – digital banking is the way all businesses will handle financial transactions going forward.

The process is not a simple one though. According to expert banker Vikas Dimri at Deutsche Bank, Indian banks and others across the world are going through the stages to transfer from traditional banking services to a digital platform. That process includes:

Digitizing Physical Manual Processes

The first stage of digitalization is taking basic manual processes and converting them over to a digital format. This includes your everyday transactions such as invoicing, making payments, and going paperless for your bills.

Re-engineer Processes

Next is reframing the traditional banking process into a digital platform. This is a more technical stage, but according to Sameer Gupta from Citibank, these steps are well underway already.

Create New Products

Probably the most exciting stage comes when banks start to develop new digital products to better enhance their customers’ experience. From working capital to invoicing and money transfers, banks are working tirelessly to revamp their platforms so that SMBs will have more efficient fintech solutions to their everyday and global problems.

Joining the Past with the Future

The goal of new digital banking initiatives is to make it simpler to manage banking. However, one of the hurdles that banks have to overcome when making the switch from traditional banking channels and procedures over to a digital platform is, ironically, the customers themselves.

Even in today’s technology-hungry society, people are still holding on tightly to the traditional banking format. Some people love their branch and some hate having to stand in line at one. Yet people are staunchly devoted to the idea of having a branch to call their own.

As such, many branch features are still not available online. According to Vikas Bhauwala of ICICI Bank in India, banks are currently working very hard to correct this discrepancy. As the digital revolution sweeps the nation, banks need to provide customers with the same level of service, personalization, and trust that traditional branch banking currently supplies. Luckily, digital banking is designed to do all that and more.

Big Benefits for the Digital Boom

Adopting a digital platform for your banking is going to usher in several major benefits for small and medium-sized businesses. In addition to streamlining processes, making it easier for banks and customers to get things done, digitalization will afford businesses with the following benefits:

Personal Expertise Wherever You Are

Global marketplaces like Amazon are making international selling a more viable option even for smaller-sized businesses. Cross-border payments, local versus foreign taxes, compliance and foreign invoicing are all issues that the previous generation of SMBs didn’t have to deal with.

As our reach expands, so do our business complexities. According to Sameer Gupta though, this is one of the hurdles that digital banking is meant to overcome. These banks aim to be SMBs’ local expertise for banking in other countries. They intend to provide you with support within your local environment even when working overseas.

Presence Across the Globe

Taking things one step further, digital banking allows even smaller-sized businesses to extend their customer reach across the globe. While conventional banking is heavily based on documentation and local presence, a digitized platform eradicates those borders increasing revenue and growth for all businesses.

Instant Payments Even in Cross-Border Payments

To complete the global selling trifecta, digital banking provides a simple and affordable means of sending and accepting payments even across borders. Limitless possibilities are opened up by plugging into local (and faster) payment schemes for cross- border transfers.

Paperless Transactions

The entire world is shifting towards paperless. From paperless bills to online application forms, everywhere you turn they’re doing away with wasteful paper transactions. Digital banking helps SMBs cut costs and time on documenting printing. That means things will move much faster both in the initial stages of a transaction and later on down the line since customers will not have to rely on someone manually.

More Transparency is Good for Everybody

With everything online, information is more readily available to banks. When a lender can see how your goods are moving from one place to another, time status of tracking, etc., banks are more confident to finance. When they can see the real numbers in real time (because the information is readily available), banks will be more willing to finance faster and more readily. It also means you can expect lower rates.

Working Capital/Financing Options

SMBs also have more access to working capital and other financing options. Banks can accept documents in digital form and use online applications for loans and other financial products. This enables a faster application process, faster underwriting process, and faster approval. What once took 45 days to two months for approval can now be had in ten to fifteen days.

With digital banking, you can send out bank statements, invoices, everything you need. Banks can process it all quickly since everything is readily available. The end result is faster access to credit/capital.

Customize Products for You

Finally, with digital access, banks are able to customize the products more appropriately. This is a more convenient option, but it is also more cost-effective since SMBs won’t have to pay for features/limits they don’t need.

Digital Banking: It’s Not a Question of If, But When

Digital banking has more tricks up its sleeve including machine learning, analytics, and digital invoicing. From shipping bills and transactions requests, to limits getting reassigned and more, everything can be done with a click of a button.

The post Can Digital Banking Initiatives Deliver Better Banking for SMBs? appeared first on The Payoneer Blog.

-

View all news of Payoneer

Posted on October 16, 2019A simplified guide to international exchange rates and fees

International exchange rates are part of what make the world’s economy so dynamic. The constant ebb and flow of rates rising and falling make some frustrated, while others are left elated. Understanding and mastering international exchange rates is an important part of running a global business; falling for the misleading information often presented can leave you with a lot less money in your pocket. We’re here to bust a few myths when it comes to currency exchange rates and fees.

What affects exchange rates?

The events happening at any given time determine the demand for a said country’s currency; the strength of the economy, serious political events, even the weather. The interest rate paid by a country’s central bank largely contributes to how much in demand a certain currency is. If the interest rate is higher, then the currency becomes more valuable.

What happens is that when a currency is seen as more desirable with a high interest rate, investors exchange the currency they have for the higher one. The country’s bank then holds onto the exchanged currency in order to eventually receive a higher interest rate.A country’s money supply is pertinent to the country’s central bank activity and decision-making processes. For example, if a government prints too much of their currency, then that is indicative of a problem: there’s too much money around that is going after too few goods. As such, holders of this country’s currency create inflation by budding prices up of local good and services. A more extreme case would be hyperinflation, which is characterized by too much money being printed as the result of having to pay off war debt, or some other large, national debt.

Similarly, any economic growth, or lack thereof, has the ability to strongly impact the status quo regarding a currency’s exchange rate. The country’s goods and services will only be invested in if their economy is booming, because it will need more of the currency itself in order to continue providing said goods and services. If a country isn’t demonstrating little or no stability, there will be less willingness on the behalf of investors to invest in its currency.

Learn more about Payoneer fees

Myth #1: There are many different exchange rates

What can become quite confusing and misleading with exchange rates, is the notion that there are many, many different exchange rates. If you call your bank and ask them what “their” exchange rate is for transferring one currency to another, you’ll get one “rate”. If you check at your local change shop, you’ll get another. Is a customer expected to shop around to find the best rate?

There is only one, true currency exchange rate. That is the mid-market rate (or inter-bank rate). It is basically a midpoint between supply and demand for a specific currency in the global markets, and because supply and demand are not fixed entities, they change all the time. At any given moment, there is only one mid-market rate. If you want to find out what it is, check out Yahoo Finance, XE, or any other independent source (not a financial establishment). This leads us into our next point, where commissions and fees play a role.

Myth #2: 0% commission

When withdrawing foreign currency, the first thing that might come to mind is the fee: What will I have to pay to change X currency to Y currency? Many financial establishments will promise you “0% commissions” or “no fees”. Are we to believe they’ll be changing the money for free?

Regardless of the commonly promised “no commission fee” establishments that you can find in many places, such a concept doesn’t really exist at the end of the day. What often happens is that the establishment will calculate their fees to be included as part of the exchange. For example, if the exchange rate from EUR to USD is €1 = $1.20, your bank may tell you that “their” exchange rate for these currencies is €1=$1.16. This makes it appear, to the unsuspecting customer, that there is no fee. But what does this essentially mean?

If you change €100 to USD, you should get $120. However, the bank has a 3.3% fee for exchanging these two currencies, so you’ll only end up with $116 in your pocket at the end of the day (they took $4 as the fee). See how this works? 0% fees is actually 3.3% fees in this case.The good news

Frustration towards an entity that is very difficult to control is a completely understandable reaction to have towards international exchange rates. However, next time you have to exchange currencies, just know that you do, in fact, have more of a say in the matter than before.

At the end of the day, the only reliable and transparent exchange rate is the mid-market rate. If you’re transferring money from one currency to another, work with an entity that doesn’t hide its exchange fees. No secrets, no “0% commissions” fallacies.

Naturally, there will always be fees, but in order to accommodate the public, while they are entitled to their share for providing the service of exchange, companies that exchange funds should strive to ensure that the focus of their services stays on doing whatever they can to ensure that a customer gets as much of the exchanged currency as possible. If you come across another exchange rate establishment, claiming to have the ‘best rate’, or work without commission, ask them about the real fee, and they’ll give you the look of a deer in headlights.

Learn more about Payoneer fees

The post A simplified guide to international exchange rates and fees appeared first on The Payoneer Blog.

-

View all news of Payoneer

Posted on October 16, 2019Utilizing Amazon to Increase eCommerce & Deciphering Top Consumer Trends

Did you know? Amazon generates a staggering 50% of the online sales carried out in today’s eCommerce market. For an astute seller this should tell you one thing – you need to hop on the Amazon bandwagon fast!

Whether you’re just starting out in eCommerce or you already have an Amazon store and want to utilize it for greater revenue, this in-depth talk from Parthiv Shah will give you all the answers you’re looking for. To watch his full presentation, click below.

Parthiv Shah takes you through every aspect of Amazon selling including how to understand the global markets, online store set up tips, and deciphering the top consumer trends on Amazon today. Read on for some invaluable information you can use to set up a profitable Amazon eCommerce store.

Today, people are far more comfortable buying online than they ever were before. You can purchase anything from basic school supplies to more sensitive items like life insurance policies and financial transactions.

In fact, eCommerce is a $400+ billion online industry. Roughly $2 billion+ of that total can be accredited to small and medium-sized businesses…in a single day! Those are figures that a brick and mortar shop would never even dream of, but when you expand your marketplace options, great things start happening.

What is Global Selling?

One of the major benefits of selling on Amazon is the fact that it opens you up to global selling opportunities. What is global selling and how can it help your eCommerce site? In short, global selling is the ability to open your product offerings to the global marketplaces. You can sell your products not just in India, but all over the world.

Some of the biggest international markets include the US, Canada, Mexico, France, UK, Italy, Germany, Spain, India, Japan, Australia, and the UAE.

What are the Benefits of the Amazon Marketplace?

Selling globally expands your audience considerably and according to Shah, with an Amazon seller account, you can reach hundreds of millions of customers in just 12 countries. That’s a tremendous increase in sales revenue just by opening up your doors to a greater customer base.

Having a global audience offers you a wider customer base because you are not dependent on a specific season. By selling to a single geographic location, you’re tied to that area’s seasons, holidays, calendar dates, social, government, and political events. When you expand your audience to include other countries though, you vastly increase your seasonal options and vis a vis sales potential.

For example, if your entire customer body is situated in India, then you’ll have strong sales peaks in October around Diwali. If you expand your reach to the US audience, you can enjoy sales peaks during the local American holiday seasons as well including Valentines Day, Christmas, and more. Amazon sellers will see more customers converting through the entire sales funnel.

What’s more, research has shown that 66% of all searches start on Amazon. The obvious takeaway? Shoppers are turning to Amazon before they do anything else. Be where the crowds are and you’ll increase sales inevitably.

Managing Global Operations, No Problem with Amazon

A major issue that arises when Indian sellers start to consider the prospect of global selling is how they are going to manage such operations. International shipping, cross-border taxes, and mass orders make the entire endeavor seem impossible. Many Indian eCommerce stores kill the dream before they’ve even begun the process.

Shah runs through the entire order of operations and explains exactly how an Amazon seller can easily manage international operations. In a word, it all boils down to FBA. Fulfillment by Amazon is a program that offers sellers within the marketplace the opportunity to store, catalogue, organize, and ship their products from an Amazon warehouse. Among the many services provided via the FBA feature include:

- Storage facilities

- Packaging

- Shipping

- Peace of mind

Here’s how it works:

- A customer goes on Amazon and sees one of your products

- They order the product via your Amazon store

- Amazon takes one of these items from your inventory, packs it up, and ships it out to the customer

Everything is handled by Amazon and as you can imagine, there are many benefits to this program. For one thing, customers trust Amazon. The shipping quality and speed are all insured by Amazon, so you can give your customers the reliable service they deserve. This also means you gain credibility.

Also, your orders are fulfilled faster for better supply and demand. Finally, you can save tremendously on shipping charges. Shipping in bulk to the warehouse is more cost-efficient than shipping individual orders.

Understanding Consumer Trends on Amazon

Like every sales channel, Amazon has specific seasons where products flourish. Learn how to analyze these trends and predict upcoming ones.

Best Selling Items on Amazon Right Now

Want to get things off on the right foot? Here are a few items that are smoking hot on Amazon right now:

- Kids cars, toy carpets, collectible dolls, and anti-chafe balm

- Alexa TV remote, Echo Dot smart speaker, and Fujifilm INSTAX mini film

- Fujifilm Instax camera

- Donkey Kong Nintendo Switch and PlayStation Store gift cards

You also want to pay attention to timing when it comes to the Amazon trend for optimal revenue generation. Q1, Q2, and Q3 are slower compared to Q4, but Q2 is starting to increase in popularity. This is especially true for fashion (no surprise that Q2 is in the spring when fashion is at its height).

Gardening and environment industries also increase in Q2. So you’ll see an upsurge in the sales of items like biodegradable products, lawn furniture and anything environmentally-friendly.

Top Tips for Selling on Amazon

Here are a few tips from Shah and other industry experts to maximize your profits from Amazon and other global marketplace sales channels:

Pay Attention to Global Differences

With various global audiences comes various differences in culture and more. Pay attention to these differences because they’ll mean the difference between successful multi-channel sales and a flop. Notice global differences in color preferences, sizing charts, and seasons.

Create Selling Product Listings

Make sure you maximize your sales potential by providing attractive, productive, and smart product listings. Each product listing should have relevant keywords, informative and accurate product details and numerous product images.

Get Paid with the Right Payment Solution

With Payoneer’s cross-border flexible payment solution, sellers on Amazon can receive international payments to one consolidated account and access their funds from anywhere in the world. If you’re starting an Amazon business or already selling products on Amazon, consider a trusted payment provider that will enable you to expand your business.

Level Up Your Business with Amazon Global Selling

The world is a big place. Don’t limit your business to a single region. Get on an online marketplace and watch your online business go global.

The post Utilizing Amazon to Increase eCommerce & Deciphering Top Consumer Trends appeared first on The Payoneer Blog.

-

View all news of Payoneer

Posted on October 10, 2019Payoneer Sponsoring Money 20/20 – Join us in Vegas!

We’re excited to announce that Payoneer will once again be one of the sponsors at Money 20/20 in Las Vegas, USA from October 27-30th. We’d love to meet you there!

Money 20/20 is the premier global event of the year that brings together the largest and most powerful leaders in payments, fintech, banking and financial services. The event brings together innovators and dreamers from the industry who are disrupting the way in which consumers and businesses manage, borrow and spend money.

As for this year’s theme? Journey to the Future of Money – a mission to help bring your business the tools and connections you need in order to become a key player in this ecosystem’s ever-changing future.

We’d love to connect with you during the conference!

- Visit us at Booth #4917 to learn more about what we do and to pick up some fun swag!

- Attend our “X-Border Customer Journeys” workshop on Sunday, October 27th, where you can hear from TJ Hyland, Payoneer’s Head of Americas eCommerce Partnerships and Daniel Webber, Founder/CEO of FXC Intelligence.

- Come chat with us! Money 20/20 provides a great opportunity to meet with Payoneer executives and platform experts. Fill out our meeting request form.

- We’re also hosting a VIP cocktail reception with our valued customers, VCs, and banking partners — invite only!

To read more visit the official Money 20/20 website.

We hope to see you in Las Vegas!

The post Payoneer Sponsoring Money 20/20 – Join us in Vegas! appeared first on The Payoneer Blog.

-

View all news of Payoneer

Posted on October 8, 20194 Easy Tips to Recession-Proof Your B2B Marketing

Editor’s note: This is a guest post by Gregg Schwartz, VP Sales & Marketing at Strategic Sales & Marketing.

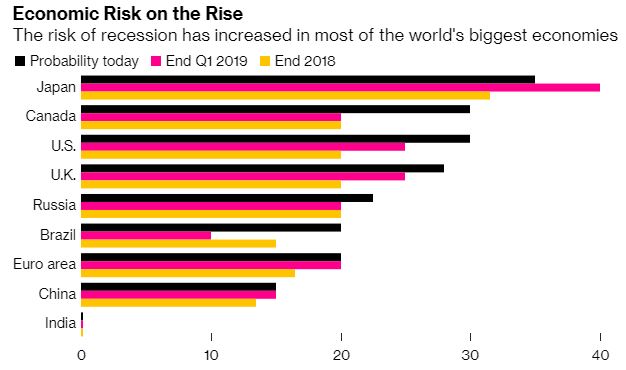

Recent turbulence in the stock market, worrisome signals from the bond market, and ongoing trade disputes between the U.S. and China are all sending strong warning signs that we could be on the verge of a recession.

We’ve been enjoying a 10-year period of overall economic expansion, but as they say – all good things must come to an end. Even if things are going well for your business today, you should still brace yourself for possible economic downturns that could be on the immediate horizon.

Source: Bloomberg.com

Here are a few ideas on how to recession-proof your marketing strategy and build up resilience for possible economic downturns.

1. Diversify Your Customer Base

Are you relying too much on just a few major accounts, customers, industry categories or market segments? Even if you have found a profitable niche during the boom years, that doesn’t mean you should assume that these same customers are going to be around forever in case of a recession.

Think strategically about your portfolio of customers. For example, are some of your customers in growth industries that didn’t exist 5 years ago? What happens if your customers’ industry suffers a downturn or a shortage of financing – are you possibly vulnerable to a bubble that is about to pop? Are your biggest markets vulnerable to any particular changes in ease of access to funding, shifts in economic policy, or downgrades in international trade conditions?

Since many businesses have been hit hard by the recent trade disputes and tariffs between the U.S. and China – you might want to diversify your business away from one or two particular countries or markets.

Ultimately, diversifying your base of customers is a smart approach, because it will help you build a broader safety net for your business. Instead of relying on just a few customers, or just a few types of customers, you can expand your marketing presence into a wider variety of situations – so even if a recession hits, you’ll be more likely to be able to keep making sales.

2. Cut Costs Now

Review your overall spending on marketing. Are there any marketing strategies that are underperforming, any marketing channels or platforms that haven’t panned out? Reduce expenses in those areas, and bulk up your cash reserves or put that money into better-performing strategies instead. When the economy is going strong and sales inquiries are coming in, it’s easy to assume that everything is fine and stop casting such a sharp eye onto your marketing budget. But good times are an ideal occasion to trim the fat out of your marketing budget.

Saving some money now and re-directing your marketing investments away from some poorly-performing activities and toward some higher-potential ones, is an ideal way to give your company an additional financial cushion to help ride out the possible downturn.

3. Expand into New Markets

Part of diversifying your base of business is making sure you have different streams of revenue from different types of markets, products, and industries. If a recession does occur, not all industries will be equally affected as some industries tend to be more stable than others. For example, if you mainly sell to fast-growing tech startups, you might want to consider selling to some more established companies or industry sectors or start selling to government agencies.

If your primary customers are concentrated in a particular B2B industry that has been seeing intensifying competition, you might want to start marketing to a totally different industry that is perhaps not as fashionable or frothy, but that is a good fit for your solution.

Think carefully and critically about what is your core value proposition and how could the solutions that you sell be relevant to the needs of different types of customers; what about your solution is transferable to different industries and different types of organizations? It might take time and energy to learn how to market and sell to different customers in a different industry setting, but it’s worth it if you can create a broader base of business.

4. Take Calculated Risks

When times are good, it’s easy to get complacent. When money keeps coming in, it’s easy to take your foot off the gas and coast for a while. But remember, the best time to make bold moves is when you’re already in demand. Keep pushing the envelope and trying new things.

Do you want to experiment with a new product launch, try some new marketing channels, invest in professional development, attend a big-name industry conference, or otherwise put yourself out there to take your business to the next level? Now is the time. Especially if the phone is already ringing with new customers, if you’ve got money in the bank, if you’re feeling confident, you might not get a better chance than right now to try some exciting new marketing strategies.

In conclusion, don’t get blind-sided by the next recession. As business leaders, there are many things we cannot control, but we can control how well we adjust and respond to the new challenges that are emerging around us.

The next recession could happen at any time, but that doesn’t mean you should panic. Instead, use this moment as an opportunity to take a step back, and enact careful planning and prudent strategies to make your company’s B2B marketing more resilient, responsive, and hopefully recession-proof!

Gregg Schwartz is the Vice President of Sales and Marketing at Strategic Sales & Marketing, a lead-generation firm based in Connecticut, USA.

The post 4 Easy Tips to Recession-Proof Your B2B Marketing appeared first on The Payoneer Blog.

-

View all news of Payoneer

Posted on October 7, 2019Instagram Stories for eCommerce: Why Bother and How to Use Them

Editor’s note: This is a guest post by Hugh Beaulac, SMM manager and content strategist at MC2.

Instagram has gained in popularity over the last few years. Today, it’s the fastest growing social media network with the most engaged audience. According to Business Instagram, there are over one billion users on the platform in which 80% of Instagrammers follow at least one business, and 60% of people discover new products in-app.

In other words, Instagram has great sales potential for eCommerce businesses. The company knows it, so it rolls out more and more business-specific features like product tags and eCommerce checkout to improve the customer shopping experience.

If you want to sell your products fast, give short-lived content a try. In fact, back in 2016, when Instagram Stories were introduced, no one could have predicted the rise of ephemeral content.

Today, over 500 million Instagrammers create or watch Stories daily, so it has become easier to use urgency to increase sales. Why? With a limited lifespan of 24 hours, this content creates the FOMO (fear of missing out) effect, so users spend much time watching Stories. For brands, this means a great opportunity to increase sales fast. It’s no wonder that more and more brands use Instagram Stories these days.

Best Practices of Using Instagram Stories for eCommerce

1. Product Announcement

With a great number of competitors on the market, having a diverse line of products is a proven way to attract new customers and keep existing ones. Moreover, the number one reason why modern customers follow their favorite brands on social media is the fact that they are interested in your products or services. People want to learn about your new products before the launch, so you need to spread a word about this launch to build anticipation, and using Instagram Stories is a great idea.

For example, Summer Fridays announced a new product launch via Instagram Stories and invited niche influencers to cause a buzz among their communities.

When you spread the word about your new product, you help potential customers understand more about the way it works and get them excited about it. As a result, people are waiting for the launch day to give it a try.

2. Time-limited Deals and Offers

If you want to increase eCommerce sales via Instagram, you need to give your followers a solid reason to give your product a try, so it’s important to keep a focus on your current product offering that helps to solve customers’ problems without spending much money. Thus, it’s no wonder that sharing time-limited deals is a great way to grab your followers’ attention and encourage them to become customers.

People want to find the best deals on the market, so sharing time-limited offers is a proven way to grab their attention. Here’s how Whole Foods Market promotes its deals via Instagram Stories:

Although short-lived content disappears within 24 hours, it’s important to create eye-catching Instagram Stories that encourage followers to learn more about your deals, and therefore become your customers.

3. New Product Launch

If you’ve launched a new product, that’s great. It gives your customers an additional reason to buy your products. However, having a new product means nothing unless you have customers who are interested in giving it a try. Since the majority of Instagrammers discover new products on the platform, you need to promote your product via Instagram Stories to cause a buzz around it.

Let’s take Dunkin’ Donuts, for example. In honor of the pumpkin coffee launch, the company used Instagram to tell its followers about the new product. Dunkin’ created Instagram Stories to introduce the full list of Pumpkin’ stores in an interesting way:

As one of the largest coffee chains in the world, Dunkin’ has many Instagram accounts for different countries, but it knows that the main audience uses its official page to search for the branded information. With nearly 12,000 locations in 36 countries, the company needs to inform its local customers about the 8 re-branded stores where they can buy new pumpkin coffee beverages.

4. User-Generated Content

In the era of sponsored posts and paid advertisement, customers find peers’ reviews and recommendations as social proof to make the right purchase decisions.

In fact, 87% of customers trust product recommendations from friends and family. For eCommerce brands, this means that posting user-generated content is a must. When potential customers see fan-made content, it gives them a solid reason to trust your brand and choose it from the variety of other options on the market.

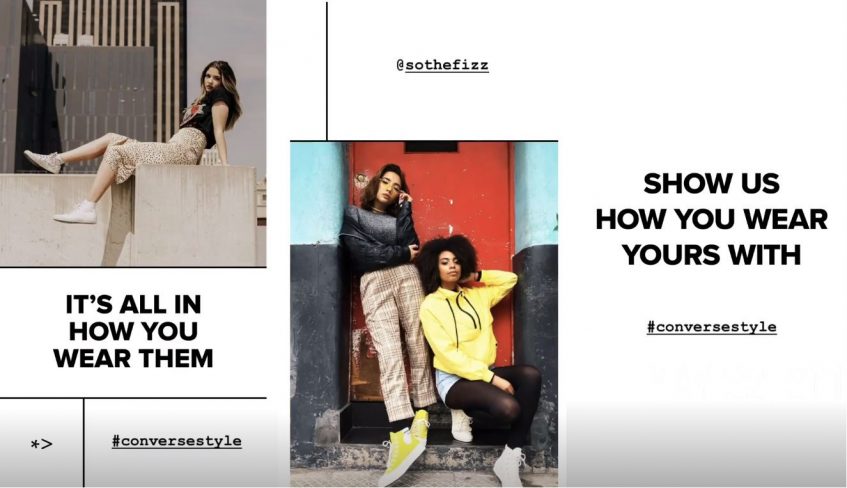

With Instagram Stories, it’s easy to publish user-generated content without clogging the main feed up with images. Apparel company Converse not only publishes user-generated content, but they also add photos to Instagram Stories Highlights to make it easier for new visitors to get social proof fast:

If you’re not a large company, it can be difficult to encourage customers to create user-generated content for you. Thus, you can collaborate with niche influencers to make fan-made photos that can stimulate other customers to take photos of your product.

The Bottom Line

Instagram has become a great marketplace for eCommerce brands that want to sell their products in-app. With the popularity of Instagram Stories, it’s easier for companies to increase eCommerce sales without spending much time. Moreover, there are several proven Instagram Stories ideas that grab your audience’s attention and encourage them to take this desired action faster.

Hugh Beaulac is a content strategist at MC2 website who also works freelance as an SMM manager to help SMBs grow online. With the love for social media, Hugh keeps an eye on digital marketing trends and writes for top-notch websites to share his marketing tips and tricks.

Hugh Beaulac is a content strategist at MC2 website who also works freelance as an SMM manager to help SMBs grow online. With the love for social media, Hugh keeps an eye on digital marketing trends and writes for top-notch websites to share his marketing tips and tricks.The post Instagram Stories for eCommerce: Why Bother and How to Use Them appeared first on The Payoneer Blog.

-

View all news of Payoneer

Posted on October 3, 2019Need to Relax? Here’s How to Actually Take a Vacation as a Full-Time Freelancer

Work hard, play hard – but what’s all that hard work worth if there’s no play?

Every worker needs time off to recharge and destress and when you’re a full-time freelancer or small business owner, you might need more vacation than you thought. Unlike company employees, freelancers don’t benefit from the typical paid vacation leave as there’s nobody to pay you when you’re off but you.

Taking time off is good for your business, your well-being and ultimately boosts productivity.

The Freelancer’s Dilemma

Today, specifically in the US, about 57 million workers have decided to ditch the 9-to-5 life to pursue their passion and work from anywhere in the world, but that doesn’t mean that it has to come at the expense of time off.

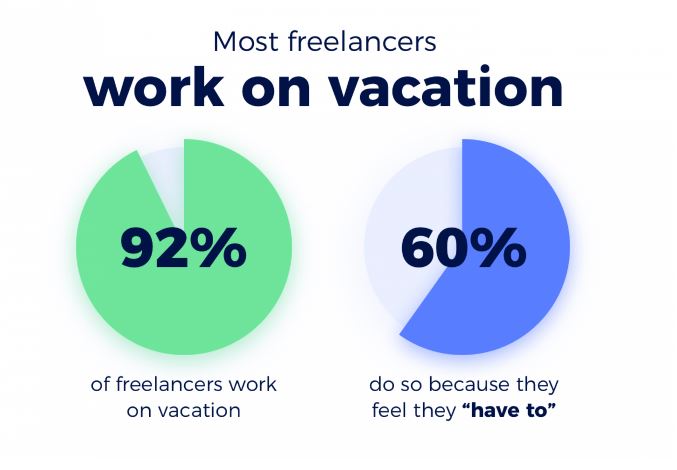

Unfortunately, a recent study by HoneyBook, a business and financial management platform for entrepreneurs and freelancers found that 92% of freelancers feel they must work while on vacation. In fact, the study also found that nearly 43% of freelancers have felt the need to hide their vacations from their clients.

Source: Honeybook.com

Source: Honeybook.com

Unplugging continues to be a common challenge for many professionals, but with careful planning, you’ll be able to take all the vacations you want without hurting your income. Freelancers and entrepreneurs should enjoy a well-deserved vacation.

Here are 7 surefire ways to plan you next vacation…and feel good about it!

1. Tell Your Clients in Advance

No client of yours wants to be surprised with an out of office message while trying to contact you. Instead, give them a heads up and make sure to notify them that you’ll be taking time off and what they should expect from you while you’re away. Remember, no means no so if you’re really planning on disconnecting from your work completely then make sure to emphasize that you will not be available, unless there’s an urgent matter in which you can offer a secondary contact.

2. Hire a Virtual Assistant

More and more small business owners are relying on virtual employee assistants to help them manage their day-to-day operations. As a freelancer that’s planning an ideal vacation, delegating more of your administrative tasks to someone else can offer you some relief and peace of mind, especially right before you set off for your trip. Train and guide them properly before you go and they can help you with personalized responses to emails, answering your office phone (if you have one) or dealing with inquiries on social media.

In addition, virtual assistants typically are not very expensive, so even if it’s just for while you’re away, it can be well worth it.

3. Set a Budget

One of the biggest challenges of working in the gig economy is the lack of paid time off. While planning your vacation, it’s highly recommended to make a budget so that your salary doesn’t feel the cut. This way you’ll know exactly how much you’ll spend on your vacation and you won’t have any surprises.

If you’ve planned your vacation well ahead of time, then you’ll have more time to save and ultimately, more to splurge! Planning in advance gives you the chance to set aside a small amount of your income each month towards your trip.

4. Keep Your Social Media Presence Alive

Just because you’re taking some time off doesn’t mean you need to fall off the planet. Be sure to schedule your content in advance and promote your services while you’re out of office. Keep your social media profiles alive with tools like Buffer or CoSchedule.

For example, if you’re a content creator then you can preschedule your blog posts and social media posts for while you’re away. Afterwards, set up an autoresponder for emails and subscribers.

5. Back up All Your Work

Before you take off, back up everything and we mean EVERYTHING. Don’t put yourself in a position where you come back from the most amazing vacation and find that certain projects of yours weren’t saved. From your laptop to your mobile phone, make sure you have copies of all your work on another hard drive or store all of your work under an app, that way everything remains safe while you’re gone.

6. Double up on Extra Work Before You Go

You’re super thrilled about finally going on that dream vacation, but at the same time, you might be stressed thinking about all the expenses you’ll have. Try grabbing a few extra side projects to boost your income. Check with your current clients if they need additional help or turn to short-term gigs on freelance marketplaces.

Perhaps you have teaching skills? If you can’t find any quick side gigs through your clients or marketplaces, try teaching online. Chances are that someone out there needs your tutoring services, whether it be a specific language or subject. Putting in the extra work before going away won’t make you regret any of your splurges.

7. Recognize That You Deserve a Vacation

Yes, you’re self-employed and yes you have bills to pay, but you need to come to terms with the fact that you do deserve time off to enjoy life, just like everyone else. Time off provides a number of health and productivity benefits. Booking a vacation is part of self-care and it’s important to remember that self-care is not a luxury but a necessity to keep you and your business going full force.

Compared to your peers who work under more traditional employment, as a freelancer, you certainly have more freedom and flexibility to choose your leisure time. Our best advice? Don’t be too hard on yourself and give yourself a break.

Plan ahead, stay organized, communicate clearly with your clients and go. You’ve earned it.

Bon Voyage!

The post Need to Relax? Here’s How to Actually Take a Vacation as a Full-Time Freelancer appeared first on The Payoneer Blog.

-

View all news of Payoneer

Posted on October 1, 2019New California Bill Changes the Game for the Gig Economy

Some call it a revolution and others prefer evolution. However you slice it, one thing is clear – the gig economy is the future of work.

We now live in a world where traditional workers are changing jobs or careers multiple times, individuals are eager than ever to take on additional jobs for more income, and the internet is creating an endless marketplace of opportunity.

What is the Gig Economy?

The gig economy is a general term that refers to freelancers, part-time workers, one-off contractors, and other non-traditional employees. The term may be defined by the work arrangement, whether or not you are a permanent employee, by a legal classification, or by the nature of the work being done.

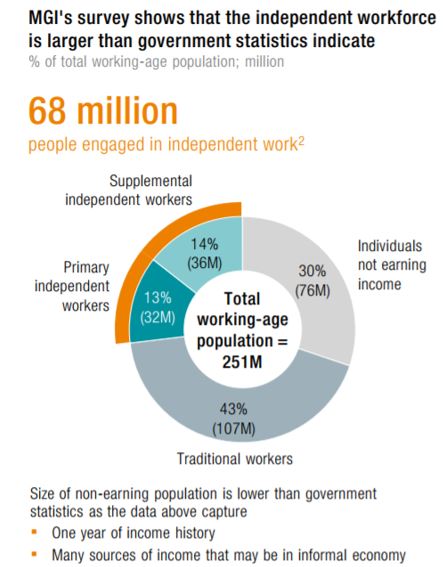

Source: McKinsey Global Institute, 2016

According to a survey by McKinsey Global Institute, nearly a third of the workforce today is provided by gig workers. With such staggeringly high statistics, it only makes sense that legislation start taking note and treating this large segment of the workforce with its proper respect.

Whichever term you use to classify your gig workers, a new law proposed by the state of California is about to change the game for remote workers.

California’s AB5 Bill Explained

The AB5 (Assembly Bill 5), also known as the Gig Worker Bill, is the most recent of the California labor laws being amended to improve labor conditions. The bill recently passed state legislature on September 11th, 2019.

This new bill expands the definition of a paid employee, requiring employers to give many independent contractors more benefits and pay guarantees. The parameters will include any worker wherein the company controls the performance of the task or if the project is part of the regular business process. This is a huge win for gig workers, and it means that many benefits that were previously withheld from independent contractors will now be required by law.

Earlier this year, the UK enforced a new law under the Good Work Plan which is aimed at improving workplace conditions and catering to the needs of remote workers in the UK. The new law ensures that all workers in the UK receive a payslip which will include the number of hours worked, making it simpler for them to make sure they are being paid in full.

This comes to show that with AB5 in the works, independent contractors are dominating the market.

Gig Economy: Not a Passing Fad

Another survey by WebsitePlanet showed that freelancers are going to make up the lions’ share of the workforce in the US by the year 2027. Here are a few more numbers to show that gig workers are here to stay:

- The current freelance market is up by 7% in the last five years

- 47% of millennials are freelancing – more than any other generation before

- 80% of workers want to have remote work assignments and 50% of US jobs are actually quite compatible with remote work conditions

- Freelancers contributed $1.4 trillion to the US economy in 2017 alone

Yes, there is no question that freelancers are becoming more accepted as proper employees and not simply independent contractors. AB5 recognizes this shift, and it promises to transform the way independent contractors are treated.

What Does This New Bill Mean for the Gig Economy?

To the general approval of roughly 30% of the workforce, AB5 is ushering in several policy reforms in how employers classify and treat their gig workers as well as traditional California freelance payments. Now many of these independent contractors will have access to the same or similar rights as traditional, long-term employees. Some of the benefits that will soon be required by law to be provided by an employer to their gig workers include:

- Minimum wage guarantee

- Overtime pay

- Sick leave

- Family leave

- Unemployment insurance

- Disability insurance

- Workers comp

- Sexual harassment protection

- Other workplace discrimination protection

- Social security benefits

- Medicare benefits

The benefits are manifold, and as usual, other states are looking to California to see where the future of their own legislation will be taken. If all goes as plans, California governor Gavin Newsom will sign the bill and AB5 will go into effect on January 1, 2020.

Who Opposed This New Bill?

While the bill was passed in a 29-11 vote (56 to 15 from the Assembly), AB5 was not welcomed by all. In fact, opposition was raised by many large businesses across the sectors from healthcare and newspapers to high tech and construction. Major companies like Uber and Lyft, brands that rely heavily on gig contractors to fuel their industry, were the loudest protesters.

The obvious criticism is that AB5 will force employers into a new fiscal responsibility, placing financial hardships onto the companies which are outsourcing the independent contractors. Considering the fact that most companies only outsource a project because it is an economically-efficient way of getting the work done for less, AB5 might inadvertently cost some freelancers their livelihood. If companies are forced to take on additional financial obligations such as paid sick leave and disability insurance, employers may decide that the independent contractors are no longer worth the investment.

Jim Nielsen, a Republican senator for California poetically stated on the Senate floor “We are not witnessing the dashing of the American dream.” If all employees are to be treated equal, the benefits that come from independent contracting (more cost-efficient, more flexibility, less legal problems) are shot down.

AB5: Disrupting the Gig Economy Everywhere

The gig economy is not just looking for a free handout. Independent contractors provide businesses with a more convenient and flexible range of employees to work with, provide dedicated and quality work, and have a competitive marketplace to keep pricing at a minimum.

“Your business cannot game the system by misclassifying its workers,” Lorena Gonzalez, the Democrat assemblywoman who launched AB5 in the first place called out. This is one response to the major explosion of gig economy across the nation.

Everyone is now anticipating that this new bill will be a real game changer for California freelancers and other states going forward.

The post New California Bill Changes the Game for the Gig Economy appeared first on The Payoneer Blog.